Meta Description: The ITR filing due date for FY 2024-25 (AY 2025-26) has been extended. Know the new income tax return deadline, penalty rules, eligibility, and filing guide in detail.

Table of Contents

- Overview of ITR Filing and FY/AY Basics

- New Extended Last Date for ITR Filing FY 2024-25 (AY 2025-26)

- Why Was the ITR Deadline Extended?

- Who Needs to File ITR for AY 2025-26?

- Penalties for Late Filing Beyond the Extended Date

- Step-by-Step Guide to File ITR

- Documents Required for ITR Filing

- Common Mistakes to Avoid

- Latest Updates from incometax.gov.in

- Frequently Asked Questions (FAQs)

Overview of ITR Filing and FY/AY Basics

Filing an Income Tax Return (ITR) is a mandatory annual requirement for all eligible taxpayers in India. The Financial Year (FY) denotes the period during which income is generated, whereas the Assessment Year (AY) follows this period and is when you submit your return for that income.

For example:

• FY 2024-25 spans from April 1, 2024, to March 31, 2025.

• AY 2025-26 is when you will file your return for the income accumulated in FY 2024-25.

Submitting your ITR facilitates claiming tax refunds, acts as verification of income, and ensures adherence to the Income Tax Act.

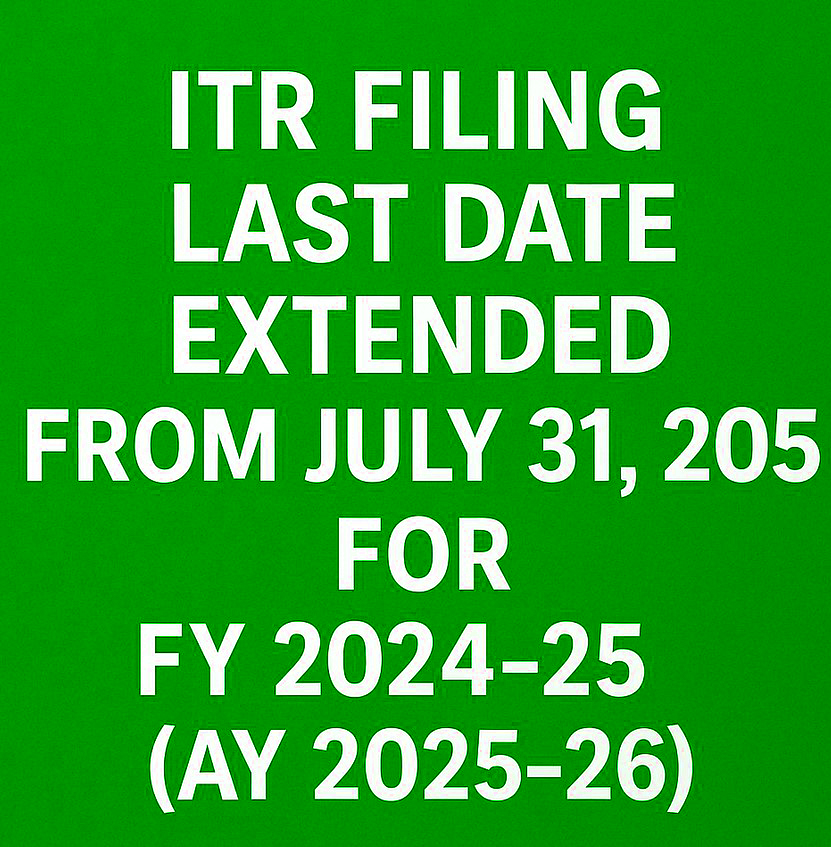

New Extended Last Date for ITR Filing FY 2024-25 (AY 2025-26)

The original due date for filing ITR for most individuals (non-audit cases) was July 31, 2025. However, the Central Board of Direct Taxes (CBDT) has now extended the deadline.

New Last Date to File ITR (Without Audit):

August 31, 2025

For Taxpayers Requiring Audit (e.g., Businesses):

Extended to October 31, 2025

For Transfer Pricing Cases:

Extended to November 30, 2025

Why Was the ITR Deadline Extended?

The government frequently extends the ITR filing deadline for one of the following reasons:

• Technical issues on e-filing portal (incometax.gov.in)

• Delays in issuing Form 16 by employers

• TDS reconciliation

• Taxpayers facing genuine hardships

• CA associations and/or tax practitioners requesting for extension

This year’s extension has been expressed because of updates to their system, along with requests from professionals for extended timelines to ensure accurate filings.

Who Needs to File ITR for AY 2025-26?

Filing an income tax return is mandatory for:

- Individuals with gross income exceeding income of ₹2.5 lakh (for individuals below 60 years of age)

- Senior citizens (60-80 years) with income exceeding ₹3 lakh

- Super senior citizens (age of 80 years and above) with income exceeding ₹5 lakh

- All companies, firms, and LLPs, regardless of income

- Individuals who are claiming refunds or carry forward losses

- Persons having foreign assets or income

- Individuals with income above the basic exemption limit before deductions

Even if your income is not taxable, it is advisable to file your ITR in order to: - Apply for visa

- Obtain loan

- Register entrepreneur/startup

- Get refund for TDS we paid acclaim returns

Penalties for Late Filing Beyond the Extended Date

If you fail to file your ITR even by the extended due date, the following penalties apply under Section 234F:

| Total Income | Late Fee (if filed after extended due date) |

| Up to ₹5 lakh | ₹1,000 |

| Above ₹5 lakh | ₹5,000 |

Additional consequences include:

- Interest under Section 234A for unpaid taxes

- Loss of ability to carry forward losses

- Delayed refunds

- Higher scrutiny by the tax department

Step-by-Step Guide to File ITR

Visit https://www.incometax.gov.in

Login using PAN/Aadhaar and OTP

Select “File Income Tax Return”

Choose:

- AY: 2025-26

- Mode: Online

- Status: Individual

- ITR Form: ITR-1, ITR-2, etc.

Auto-populate data from AIS/TIS/Form 26AS

Enter income, deductions, taxes paid

Verify bank details for refund

Preview and submit

E-verify using Aadhaar OTP or net banking

Documents Required for ITR Filing

Keep these ready:

- PAN and Aadhaar Card

- Form 16 from employer

- Form 26AS (Tax credit statement)

- AIS/TIS (Annual Information Statement)

- Interest certificates from banks/post offices

- Investment proofs for Section 80C, 80D, etc.

- Capital gains statement from mutual funds/stocks

- Rental income details

- Home loan interest certificate

Common Mistakes to Avoid

- Selecting the wrong ITR form

- Failing to declare interest income

- Missing TDS or advance tax details

- Providing incorrect bank account

- Claiming invalid deductions

- Not verifying ITR after submission

Latest Updates from incometax.gov.in

- New pre-filled ITR forms with data from AIS/TIS

- Auto-validation tools to avoid common errors

- Helpdesk support for e-filing issues

- Option to file updated return under Section 139(8A) for errors in past ITRs (within 2 years)

Frequently Asked Questions (FAQs)

Q1. What is the new last date to file ITR for AY 2025-26?

A: The new last date is August 31, 2025 for individuals that are not required to be audited.

Q2. Can I file the ITR after the extended date?

A: Yes, a late fee of ₹1,000 to ₹5,000 may apply, as well as interest.

Q3. What happens if I do not file the ITR?

A: You may receive notices from the IT Department. Also, you lose your right to carry forward losses, and your refunds could see a delay.

Q4. Do salaried employees have to file ITR?

A: Yes, if the gross income is more than ₹2.5 lakh, even if TDS, is already deducted.

Q5. Is e-verification necessary?

A: Yes. You must e-verify your ITR within 30 days; you can use Aadhaar OTP or the bank account or Demat to verify.

Q6. What is Form 26AS?

A: It is a tax credit statement which shows the total of all TDS, advance tax, and all the high-value transactions which have been recorded under your PAN.

Q7. What is the penalty under Section 234F?

A: You will be charged to a late filing fee from ₹1,000 to ₹5,000 depending on your total income.

Q8. How do I know whether my ITR is processed?

A: You can login to incometax.gov.in → Dashboard → “View Filed Returns” → there you can check the status as Processed with refund or Processed without refund.

Conclusion

With the deadline for filing ITR for FY 2024-25 (AY 2025-26) pushed back to August 31st, 2025, taxpayers will have increased breathing room. To avoid any penalties, taxpayers should gather all their documents and file their ITR early. It is important to use the official portal to stay updated and to ensure that the processing happens smoothly.

Google SEO Keywords : ITR filing last date 2025, income tax return due date extended, ITR deadline FY 2024-25, AY 2025-26 income tax return, ITR new deadline, income tax rules India, ITR penalty 2025, ITR filing extension, last date to file income tax return, ITR deadline without penalty, AY 2025-26 ITR rules, who should file ITR 2025, e-filing ITR 2025, incometax.gov.in, ITR late fee 2025

![]()

[…] is ITR Filing?Income Tax Return (ITR) Filing means a process by which an individual, professional and business makes a statement of the […]

[…] or Tax Deducted at Source is a key feature in the Indian taxation system. The government collects tax at the source of income generation, which helps couple a tax from a steady revenue source and combat […]