Meta Description: Learn everything about Income Tax Return Filing for FY 2024-25 including how to file ITR, due dates, types of forms, eligibility, and step-by-step process.

Income Tax Return Filing for FY 2024-25: Complete Guide

Table of Contents

- What is ITR Filing?

- Why is ITR Filing Important?

- Who Should File ITR for FY 2024-25?

- Due Dates for ITR Filing FY 2024-25

- Documents Required for ITR Filing

- Types of ITR Forms for FY 2024-25

- How to File ITR Online – Step-by-Step Process

- Common Mistakes to Avoid While Filing ITR

- Consequences of Not Filing ITR

- FAQs on ITR Filing FY 2024-25

- Conclusion

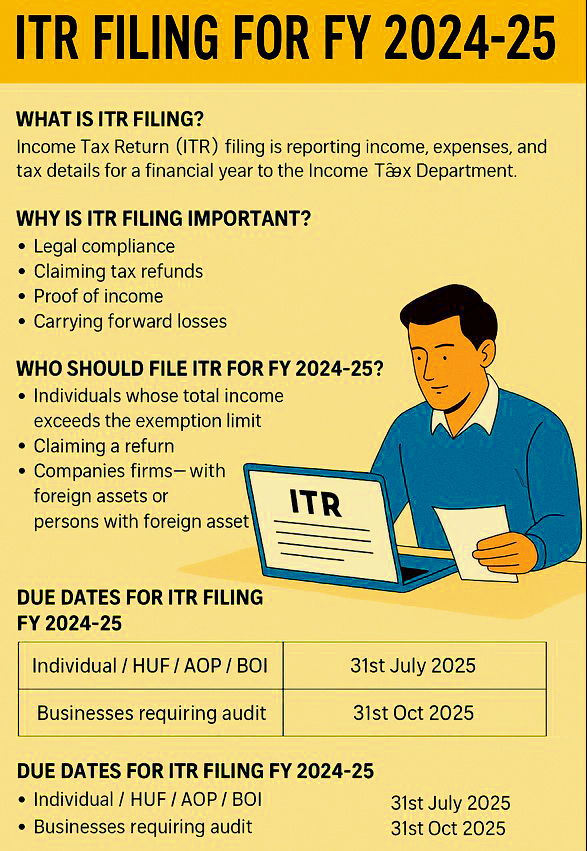

What is ITR Filing?

Income Tax Return (ITR) Filing means a process by which an individual, professional and business makes a statement of the income, expenses and tax liability to Income Tax Department of India. Report of income is mandatory for the individuals with income over a certain threshold of limit. While for others it’s voluntary if they wish to claim refund or report their income.

Why is ITR Filing Important?

- Legal compliance: Filing ITR is mandated by the Income Tax Act, 1961.

- Claiming refunds: You can only claim TDS or excess tax paid if you file ITR.

- Proof of income: Essential for applying for loans, visas, and insurance.

- Carry forward losses: Losses under certain heads can be carried forward only if ITR is filed on time.

- Avoid penalties: Non-filing can lead to penalties and interest under sections like 234F.

Who Should File ITR for FY 2024-25?

You must file ITR if:

- Your gross total income exceeds the exemption limit (₹2.5L for individuals below 60, ₹3L for seniors, ₹5L for super seniors).

- You want to claim a refund of TDS.

- You are a company or firm irrespective of profit or loss.

- You had income from foreign assets or have foreign bank accounts.

- You incurred capital gains or income from property sales.

- You’re carrying forward losses under house property or capital gains.

Due Dates for ITR Filing FY 2024-25

| Taxpayer Type | Due Date |

| Individual / HUF / AOP / BOI | 31st July 2025 |

| Businesses requiring audit | 31st Oct 2025 |

| Companies or those under TP audit | 30th Nov 2025 |

Note: Belated or revised returns can be filed till 31st December 2025.

Documents Required for ITR Filing

To file your ITR for FY 2024-25, ensure you have:

- PAN card

- Aadhaar card

- Form 16 from employers

- Form 26AS & AIS (Annual Information Statement)

- Bank account details & statements

- TDS certificates

- Rent receipts (if claiming HRA)

- Capital gains statements

- Proof of tax-saving investments (Section 80C, 80D, etc.)

- Home loan interest certificate

Types of ITR Forms for FY 2024-25

| Form | Applicability |

| ITR-1 | Salaried individuals, income up to ₹50L, one house property |

| ITR-2 | Individuals with capital gains, more than one property |

| ITR-3 | Individuals/businesses earning from profession |

| ITR-4 | Presumptive taxation scheme (44AD, 44ADA) |

| ITR-5 | Firms, LLPs, AOPs, BOIs |

| ITR-6 | Companies other than those claiming exemption |

| ITR-7 | Trusts, political parties, charitable institutions |

Choose the correct form depending on your source of income.

How to File ITR Online – Step-by-Step Process

Step 1: Register/Login

- Visit the official Income Tax Portal

- Login using PAN/Aadhaar and password

- First-time users must register

Step 2: Select Filing Type

- Choose “e-file” > “Income Tax Return”

- Select the Assessment Year as 2025-26

Step 3: Choose ITR Form

- Based on your income sources, select ITR-1, ITR-2, etc.

Step 4: Pre-fill & Validate Data

- Import data from AIS/Form 26AS

- Manually verify pre-filled data and add missing information

Step 5: Claim Deductions

- Add eligible deductions (80C, 80D, 80G, etc.)

Step 6: Review & Submit

- Confirm all details

- Submit and e-verify through Aadhaar OTP, net banking, or EVC

Step 7: Download Acknowledgment

- Save a copy of the ITR-V or Acknowledgment (ITR-ACK)

Common Mistakes to Avoid While Filing ITR

- Selecting the wrong ITR form

- Not reporting income from interest/dividends

- Mismatched Form 26AS data

- Not verifying the return after submission

- Incorrect bank details (refund issues)

- Claiming ineligible deductions

Consequences of Not Filing ITR

- Late filing penalty: Up to ₹5,000 u/s 234F

- Interest on tax dues: Under section 234A/B/C

- Loss of refund claim

- Ineligibility to carry forward losses

- Scrutiny and notices from IT department

FAQs on ITR Filing FY 2024-25

Q1. Can I file ITR after the due date?

Yes, as a belated return until 31st December 2025 with penalties.

Q2. What is the assessment year for FY 2024-25?

It’s AY 2025-26, which is the year when the return is filed and processed.

Q3. Is Aadhaar mandatory for filing ITR?

Yes, linking Aadhaar with PAN is mandatory for successful e-filing.

Q4. Can I revise my return after submission?

Yes, a revised return can be filed if submitted before 31st December 2025.

Q5. What if my income is below the taxable limit?

Filing is optional but recommended for refunds or financial proof.

Conclusion

ITR filing for FY 2024-25 should not just be seen as a compliance requirement, but a financially literate practice. Online e-filing has become easier and faster with better integration. For salaried professionals, freelancers, and comapanies, understanding your filing obligations allows you to avoid potential penalties and maximize possible refunds.

Plan ahead, and collect all the required documents for filing your ITR, do not leave it until the last minute and file before the 31st July 2025 deadline for individuals. Alternatively if you are a business & firm, ensure you can comply to audit requirements if necessary. Speak to a professional adviser if your ITR involves income arriving from multiple sources, or qualifies for capital gains treatment.

SEO Keywords: ITR filing, ITR filing FY 2024-25, income tax FY 2024-25, income tax return India, file ITR online, ITR due date, income tax return process, how to file ITR, ITR portal, e-filing, types of ITR forms, income tax India, ITR documents

![]()

[…] is a straightforward tax collection system that is also powerful. It ensures timely tax collection and transparency. For taxpayers like […]